AGNC - Q3 Results

AGNC Investments (NASDAQ:AGNC), is a real estate investment trust (mREIT) that invests in agency MBSs on a leveraged basis. It is financed by collateralized borrowings structured as repos (repurchase agreements) with an investment objective aimed at providing shareholders with attractive risk-adjusted returns through a combination of monthly dividends and net asset value accretion. AGNC IPOed at $20 a share in the middle of the financial crisis, topping out at $36 a share in 2012 and is currently down 15% YoY due to the economic slowdown offset by the pandemic although it has come a long way since the sell-off in March.

Recap on AGNC Q3 Results:

Results for the financial quarter ending 30th of September was released on the 27th of October, with AGNC largely matching or beating analyst expectations.

1. EPS grew 53% to $0.72 per share, driven by lowered financing costs, sale of securities and derivatives and successful dollar roll operations.

2. The Tangible Book Value of shares also grew 6.4% to $15.88, much in line with analyst expectations.

3. Dividends were slashed 25% YoY to $0.12 per share in an attempt to build reserves pending the uncertainty of the pandemic although AGNC later stated on a conference call that in hindsight it was unnecessary. As such, monthly dividends could go back up to $0.16 in the next quarter given that economic recovery remains stable.

4. Economic return on shareholder equity was down to 8.2% from 12% in Q2.

5. In Q3, AGNC shifted away from holdings in Agency MBS and redirected it towards its positions in the TBA (to be announced market) with 66.9b on Agency MBS, 29.5b on TBA positions and 1.2b on CRT (credit risk transfer) and non agency securities.

6. In Q3, AGNC had a CPR (Conditional Prepayment Rate) of 24.5%, higher than competitors Annaly’s 19.5%. Whilst AGNCs CPR may indicate lower risk, it also leads to overall lower profits.

7. Net Interest Spread is at 2.5% due to cheapened financing and aforementioned strategy.

8. Finally, AGNC repurchased $154mil in shares at $13.95 (including transaction costs).

Market Outlooks by GS and Rates:

Source: AGNC Q3 Earnings Report

GSAM (Goldman Sachs Asset Management) rated Agency MBS overweight and stated in a weekly letter that, ‘due to Fed support and strong demand from US banks, mortgage spreads have reached the tightest levels seen during the fourth round of quantitative easing (QE4). Additionally, the carry on production coupon mortgages remains strong. We expect this carry dynamic to persist into 2021 supported by expectations for a slowdown in supply as we enter winter, coupled with increased demand as Fed purchases increase due to paydowns. We used recent outperformance as an opportunity to reduce our sector overweight. That said, we remain constructive over the medium term due to the strong carry profile.’.

AGNC Portfolio Breakdown:

Source: AGNC Q3 Earnings Report

AGNC’s Agency MBS portfolio composition in Q3 changed slightly as opposed to Q2 with AGNC adopting a strategy of decreasing its on-balance sheet Agency MBS, particularly its 30 Year MBS, whilst increasing its TBA MBS position therefor leading to an increase in dollar roll income seen in their earnings and relatively underwhelming interest income. Their portfolio continued to be dominated by 30 Year Agency MBS’ with coupons on 3.5% and above, though the higher interest payment would be slightly offset by the higher CPR. Portfolios dominated by higher coupons such as AGNC’s doge the risk of valuation losses in a high interest rate environment such as the one we are in. Furthermore, they are able to hedge against the risk of higher borrowing costs, something that AGNC does not have to currently worry about.

However, as can be seen above, AGNC has decreased their exposure to higher coupons MBSs, replacing them with those of 2.5% and lower CRPs. Portfolios with lower coupon rates however tend to do well in environments with lower interest rates due to the increase in valuation gains which again shows a change in AGNC management’s strategy.

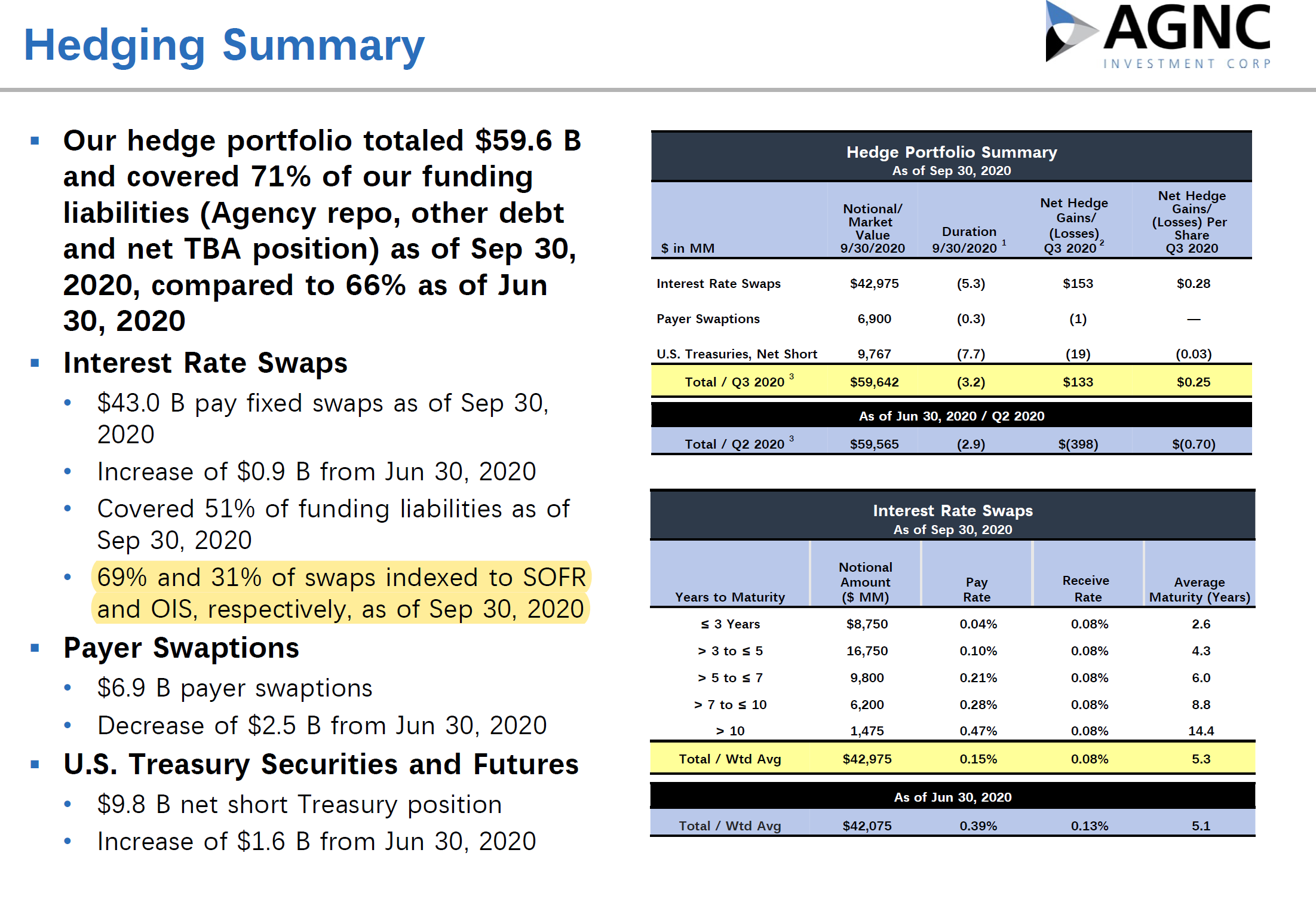

Derivatives (Hedging) Portfolio:

Source: AGNC Q3 Earnings Report

AGNC’s hedging portfolio increased 5% from Q2, with a substantial increase in their US Treasury short position. Treasury related derivatives have dropped in price since November 20th after after U.S. Treasury Secretary Steven Mnuchin said the $455bil allocated to Treasury under the CARES Act last spring that was set aside to support Federal Reserve lending should be instead available for Congress to reallocate and spend how it sees fit. This trend will seemingly continue and therefor, although about 19mil in losses were suffered in Q3, gains in Q4 and 2021 Q1 can be expected.

Financing:

Finally, AGNC financing costs have been slashed in Q2 , which is especially important since leverage is a core part of its business model with repo rates down 0.31% in Q3 as opposed to 0.41% in Q2. Repo rates is expected to be low given the Fed’s involvement following ;liquidity issues earlier in the year. In addition, cost of funds needed for its TBA and Dollar Roll ventures was down to 0.15% in Q3 from 0.81% in Q2. Given that this seems to be management’s new focus, such substantial cuts in financing costs will proof beneficial.

Conclusion:

In Conclusion, given that AGNC management continue to sufficiently hedge against financing and interest rate risks whilst successfully assessing market conditions and positioning itself to benefit from an economic recovery under the Biden administration, it seems likely that it will sustain growth.

Current price: 15.70 (24 Nov 2020 Market Close)